For investors in Georgia

For investors in Georgia

Georgia is one of the most investor-friendly countries in the world. It is ranked as 7th among 190 countries in terms of ease of doing business by the World Bank. The term “investor” has consistently been popularized and idolized by all governments over the past two decades in Georgia. Citizens are aware of the importance of foreign investors for the economic development and their well-being.

Why should you consider investing in Georgia?

Apart from the above discussed, Georgia has low taxes that encourage investors to move their business to the country. There are number of tax advantages to investing in Georgia. Below is the list of some of the most interesting benefits available to entrepreneurs. Please note that the list is not exhaustive, and you should consult firms that provide accounting services in Tbilisi and Batumi for details.

Profit tax is only paid upon dividend distribution – this is known as the Estonian model. Unlike other countries, in Georgia you do not pay profit tax on your earned profits. You only pay profit tax when you extract dividends from business. This gives businesses ability to accumulate significant profits prior to paying any taxes.

Individual entrepreneurs with “Small Business” status pay only 1% in taxes – instead of paying 20% personal income tax, individual entrepreneurs holding the Small Business status only pay 1% tax on their incomes.

Number of tax benefits are available for IT businesses – there are special statuses available for IT businesses (“Virtual Zone Entity” status and “International Company” status) that allow them to significantly reduce or altogether avoid paying key taxes like income tax and profit tax.

Free Industrial Zones – currently there are four Free Industrial Zones - one in Tbilisi, one in Poti and two in Kutaisi. There are number of tax benefits available to entities operating in such zones. The benefits include profit tax, property tax and import tax advantages. However, there are number of details that need to be checked prior to deciding to enter the Free Industrial Zones.

Each of the above listed tax benefits might offer your company significant advantages. Prior to deciding to invest in Georgia, it is recommended that you consult with companies providing accounting services in Batumi, Tbilisi, Poti, and other cities of Georgia.

მსგავსი სიახლეები

CEOs of Georgian companies Orbi Group and Block Group attended a Christmas Party at the White House

CEOs of Georgian companies Orbi Group and Block Group attended a Christmas Party at the White House

TBC received three awards from the UN Global Compact, becoming the first company to win in three categories simultaneously

TBC received three awards from the UN Global Compact, becoming the first company to win in three categories simultaneously

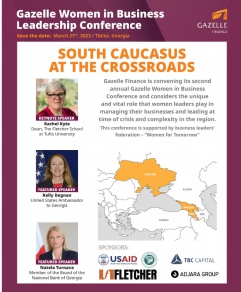

GAZELLE WOMEN IN BUSINESS CONFERENCE, 27 MARCH

GAZELLE WOMEN IN BUSINESS CONFERENCE, 27 MARCH

For investors in Georgia

For investors in Georgia

Wines of Rtvelisi have acquired worldwide recognition

Wines of Rtvelisi have acquired worldwide recognition

President Ilham Aliyev chaired meeting of Security Council

President Ilham Aliyev chaired meeting of Security Council

The VI International Congress of Real Estate and Investment 2020 ended in Berlin

The VI International Congress of Real Estate and Investment 2020 ended in Berlin

On February 25, 2020, the Berlin Congress of Foreign Real Estate and Investments will be held in the German capital

On February 25, 2020, the Berlin Congress of Foreign Real Estate and Investments will be held in the German capital

Manufacturing of pharmaceutical products in Georgia: "They are experimenting with how much we can pay for drugs"

Manufacturing of pharmaceutical products in Georgia: "They are experimenting with how much we can pay for drugs"

How will the first treetop trails look like in Georgia?

How will the first treetop trails look like in Georgia?

Enterprise Georgia presents strategy to attract foreign direct investments in Georgia

Enterprise Georgia presents strategy to attract foreign direct investments in Georgia

Georgian PM holds next interagency meeting in Gudauri following Bakuriani

Georgian PM holds next interagency meeting in Gudauri following Bakuriani

Former Presidential Residence in Mestia Sold for 7 510 000 GEL on e-auction

Former Presidential Residence in Mestia Sold for 7 510 000 GEL on e-auction

Six HPPs put into operation in Georgia this year

Six HPPs put into operation in Georgia this year

"Sarajishvili 2020" - a drink of unique taste and design for a sublime New Year's Eve

"Sarajishvili 2020" - a drink of unique taste and design for a sublime New Year's Eve

Exports to Georgia increase by 11.7% in January-November 2019, while imports decrease by 2.3%

Exports to Georgia increase by 11.7% in January-November 2019, while imports decrease by 2.3%

How much do Georgian citizens spend on domestic tourism?

How much do Georgian citizens spend on domestic tourism?

EBRD allocates $54 million to develop energy efficiency in Georgia

EBRD allocates $54 million to develop energy efficiency in Georgia

Volume of real estate owned by banks in Georgia increases

Volume of real estate owned by banks in Georgia increases

Money transfers to Georgia amount to $151 million in November 2019

Money transfers to Georgia amount to $151 million in November 2019